Update 2021/11/7: I have stepped out of the crypto market and everything I wrote down below is purely for educational purposes and doesn’t hold much value now. If there comes another version of bitcoin that makes sense to me I will re-enter but as of now, its goodbye.

We will be looking at some signs that show how the cryptocurency market is a house of cards and a ticking time bomb that could explode any day.Some shocking warning signs, that show us that the entire network can come crashing down. You have to understand what is going on in the cryptocurency market as your financial future may depend on this.Before I jump in, I just want you to remember , don’t listen to anyone, don’t give in to BS, you decide for yourself , do you really want to be the person you set yourself out to be? Let’s all stay together, keep those diamond hands and HODL!!. I promise you good things are coming for you. Don’t pay too much attention to the short term volatility, be in this for the long term. Since I started writing this post a lot more happened so let me go in the reverse chronological order to address these changes. I have been writing this post since the last weekend and there is just so much going on in the market, major FUD and good news. I want to be able to do justice so let get started with the instability and bad players in crypto and end it on a positive note with all the all good news money.

UPDATE(2nd July, 2021): We may have a solution for our Tether problem, 4 letters USDC.If Tether is the death knell, isn’t USDC the chorus?

An update on exit scams that we all must be wary off.This ties in to liquidity problem with most of these crypto exchanges. Large exchanges like Binance, WasirX, ByBit, Coinbase and a lot more are facing lawsuits for money laundering, leverage tokens , exit scams and what not. FEMA issued a notice to WasirX and we are closely tracking the story. Twitter is filled with tweets of disgruntled customers who could never close their positions.There is also a problem with leverage tokens , and most of these exchanges crash during the dips and peaks.The aftermath of all of this looks like a lawsuit but unfortunately most of these exchanges are outside of US borders and litigation procedures end up being pending. International tribuno board for litigative assistance is what you need to be able to go after them legally. I just recommend you to get all your money out of binance. Adding a link to the class action lawsuit.

Legal recourse from reddit

Class actions can be difficult, but there are a few things US users can do:

– File a report with the Federal Trade Commission on their website. The CFTC and SEC may also be interested. I can’t post links but this is all easily searchable.

– File a complaint with your state Attorney General’s office. Most states allow you to file a complaint on their website.

– Contact a consumer protection or fraud attorney who may take your case on contingency (at no cost to you)

– Read the terms of use carefully and file an arbitration claim online with the American Arbitration Association. Particularly if it’s been more than 30 days since you submitted a ticket and you’ve suffered losses. Under the terms of use binance.us is required to reimburse your filing fees for claims up to $10,000.

Tether’s Underlying Assets and the Liquidity Problem in Crypto

Let’s talk about stable and unstable coins.Let’s take it step by step by looking at the underlying asset.Most coins, or any fund has a balance sheet which shows a distribution of assets, read security backing that coin, fund what have you. If you were to analyse the portfolio for any fund or coin or even a startup go ahead and look at their balance sheet. That tells you everything. Now the ideal thing would be to have all assets backed by gold, god’s money but that isn’t ideal and most balance sheets have a mix of resources tied in as percentages describing allocation of assets.Now lets tall about Tether – the instability and the underlying liquidity problem it brings with. We will analyse Tether’s balance sheet. Now some background, it’s much easier to trade cryptocurency directly using tether instead of dollar. Tether’s claim to fame came from that you can just buy these tethers and they are 1:1 relationships to the dollar.Now what most people believe that they can take take those tether’s anytime and exchange them whenever they want. But this is not even remotely possible. We have to analyse Tether’s balance sheet to understand the gravity of the problem and the underlying asset. Most people think that Tether has an asset backing their tethers and we think we can take them and redeem them for dollars. Once we peel down the layers we realise that this may or may not be possible.Linking Tether’s terms of service and legal here for you to peruse on your own. Snapshot below( PS they have typos in there if you look closely). Thanks to George Gammon , the Rebel Capitalist show for opening m eyes to this.

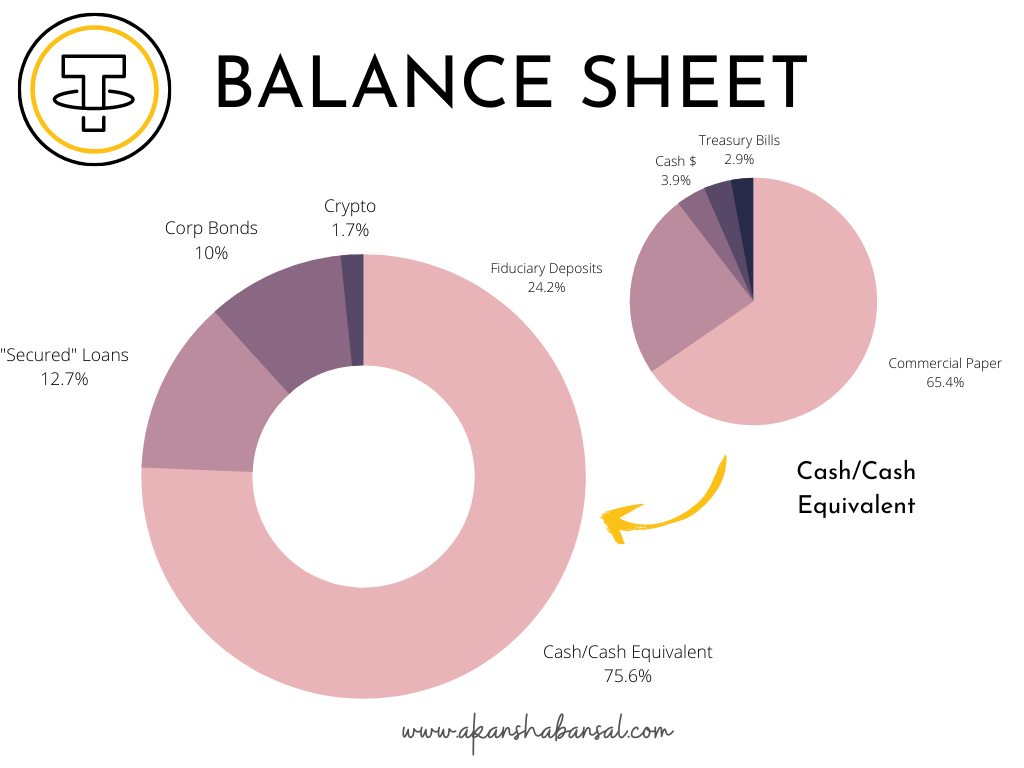

Tether’s Balance Sheet

Tether provides liquidity to a lot of markets, so if tether goes down, it brings with it the entire house of cards.Balance sheet of Tether as you can see illustrated the pie chart down below is so important to understand as it indicates how Tether can trigger the collapse of the crypto market.Let’s focus on the 75% cash equivalent and that is where things go from weird to straight up bizarre.Tether could be using your money and buying mortgage backed securities, the same securities that blew up in 2008.We have to remember why people use Tether? Its cheap, transaction costs are low may be 1 or 2 basis point but what we don’t see is that we are paying a much higher price in terms of risk that we aren’t even aware of, massive amounts of risk.

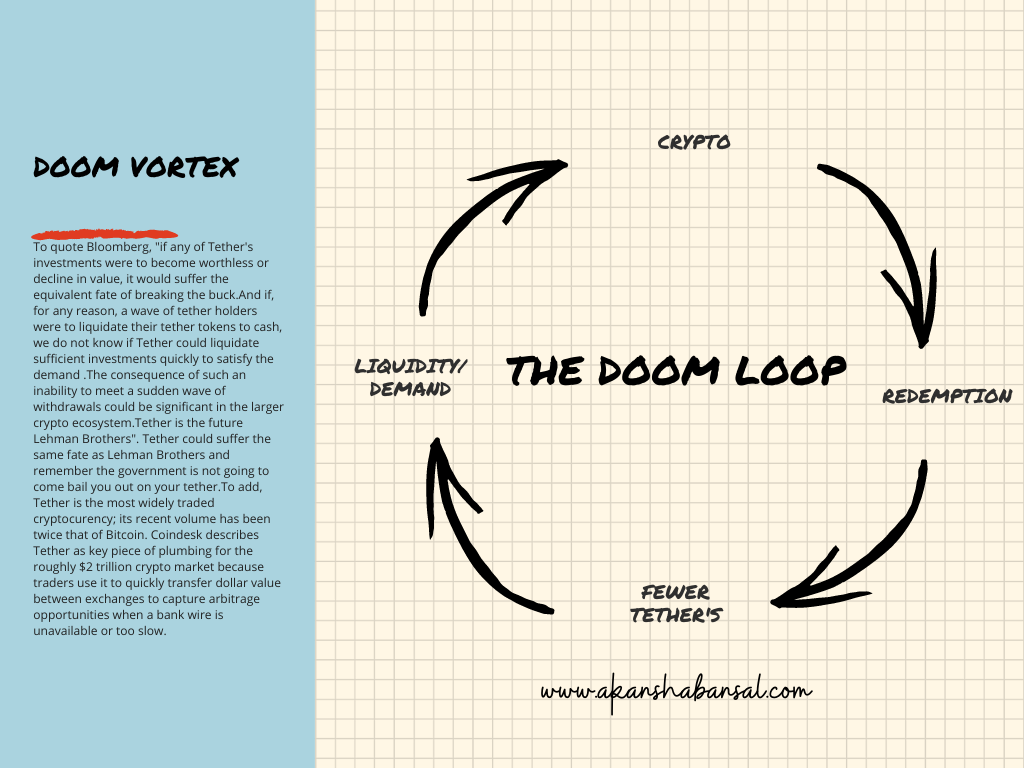

The underlying problems with this strategy is Tether’s balance sheet.To quote Bloomberg, “if any of Tether’s investments were to become worthless or decline in value, it would suffer the equivalent fate of breaking the buck.And if, for any reason, a wave of tether holders were to liquidate their tether tokens to cash, we do not know if Tether could liquidate sufficient investments quickly to satisfy the demand .The consequence of such an inability to meet a sudden wave of withdrawals could be significant in the larger crypto ecosystem.Tether is the future Lehman Brothers”. Tether could suffer the same fate as Lehman Brothers and remember the government is not going to come bail you out on your tether.To add, Tether is the most widely traded cryptocurency; its recent volume has been twice that of Bitcoin. Coindesk describes Tether as key piece of plumbing for the roughly $2 trillion crypto market because traders use it to quickly transfer dollar value between exchanges to capture arbitrage opportunities when a bank wire is unavailable or too slow.

Fraudulent Exchanges in the Crypto Ecosystem

Let’s look at leverage now. You can get up to 100x leverage with Tether. For instance if Tether takes in 1$ and issuing 3$ then its a major problem.If Tether is offering free tethers not backed by dollars, in return for say dogecoin and then you go to coinbase to liquidate. Why would Tether want the price of crypto go up? because that would directly influence the demand for Tether and then they go again to repo or corporate debts, or buying dogecoin themselves. It pumps full circle, they are artificially driving up the price. Leverage is typically referred to via the former “X” terminology in the cryptocurrency trading ecosystem. 100X leverage is the same as 100:1 leverage. If you open a margin trade with a cryptocurrency exchange the amount of capital you deposit to open the trade is held as collateral by the exchange.

Another example is Bybit, an exchange that trades in bitcoin, you move your USD to coinbase and then convert to bitcoin. Bybit offers leverage, upto a 100 times , you cant do that on coinbase.One of the biggest controversies is that they are really issuing Tether’s that are backed by assets. You require to be on VPN to access Bybit, its illegal to use in the United States.This could essentially trigger a Doom Vortex, a doom loop- what happens if Crypto goes down for an extended period of time? We have more redemptions and that leads into the same liquidity problem that Bloomberg mentioned.

Major FUD

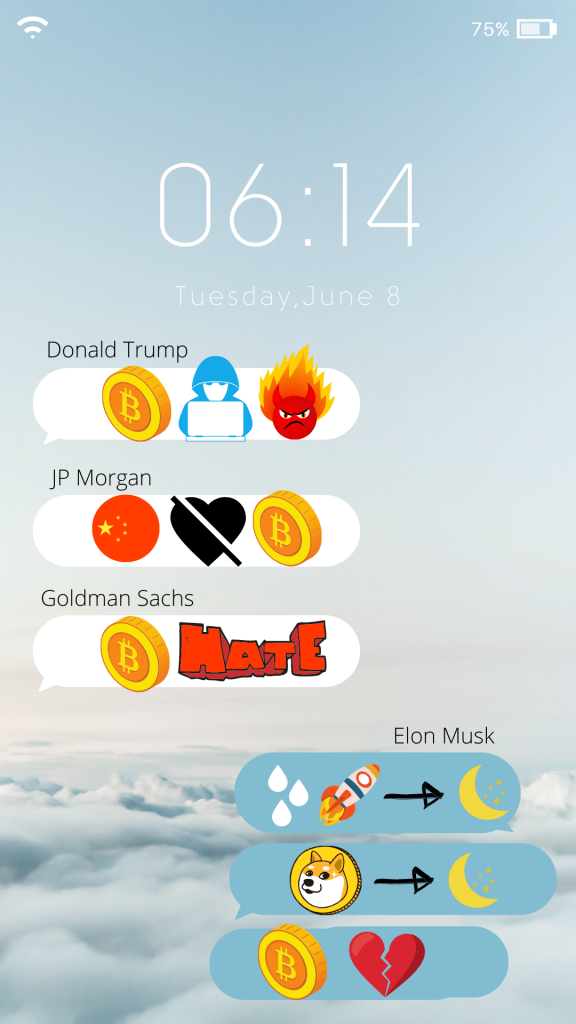

Elon Musk, has been constantly behind bitcoin, at a point he was tweeting that bitcoin is the future, then he was pumping dogecoin and that it is going to the moon, then he posted that he broken up with bitcoin and then cum rocket was going to the moon.There is a lot of FUD out here and you have to read between the lines to really understand what they are doing , not what they are saying. Two of Tesla’s major investor’s carrie wood owns a major stake in Coinbase and Blackrock holds a ton of bitcoin. Elon has been getting a lot of heat from both of them as he first thrashed bitcoin and then in an effort to pump Dogecoin he just made it all worse. Coinbase accelerated the onboard for doge and if you follow Coinbase stocks were not doing well.His tweets and actions are directly related to his personal interests in Tesla and his efforts to please the investors because that is his job as CEO of Tesla. Please enjoy this little graphic I created last night to just emphasise on this element of constant tweets and hate online.I’ll repeat, look at what they are doing and not what they are saying. With that being said I would close the topic of Elon as none of us in the crypto community are fond of what he is doing or saying.

Goldman Sachs, man oh man where do I even begin. Goldman has been constantly repeating that bitcoin is going to crash , its not a safe investment while offering its “rich” customers funds trading entirely in crypto market.Bitcoin is a “risk-on” asset akin to copper rather than gold, argued Goldman Sachs chief of commodities Jeff Currie.”Our call of the day comes from a Goldman Sachs GS, -0.89% survey, in which chief investment officers said bitcoin was their least favourite investment.”Conflicting stories such as “Bitcoin Investors in US Made $4 Billion in Profit in 2020, 4X More Than in China: Report” [link], “Goldman Sachs Commodities Chief Calls Bitcoin ‘Digital Copper’” [link],”CIO of $2.1 Trillion Asset Manager Amundi: Bitcoin Is A ‘Farce’”. And you also see conflicting news that the global investment bank will begin offering Bitcoin futures, in the form of non-deliverable forwards, to large investors [link].Little over a year ago, the investment bank said crypto was not an asset class. Now it has taken a second look.[link] I will just repeat what I said earlier, do you own research, take all news with a grain of salt, watch what they are doing and not what they are saying.

JP Morgan, Jamie Dimon said he is still sceptical about Bitcoin and has no real interest in it, but JPMorgan’s clients are keen on the cryptocurrency [link].While we see conflicting news that JP Morgan is funding crypto. Ethereum Studio ConsenSys Raises $65M From JPM, Mastercard, and Others[link]. JP morgan is also creating its own coin JPCoin for investors [link]. In 2019, J.P. Morgan became the first global bank to design a network to facilitate instantaneous payments using blockchain technology – enabling 24/7, business-to-business money movement by unveiling JPM Coin.JPMorgan to Let Clients Invest in Bitcoin Fund for First Time: Sources [link].JPMorgan Chase is preparing to offer an actively managed bitcoin (BTC, +3.98%) fund to certain clients, becoming the latest, largest and – if its CEO’s well-documented distaste for bitcoin is any indication – unlikeliest U.S. mega-bank to embrace crypto as an asset class. I mean need I go on, I know you are smart enough to know where this is headed. We all want the price of bitcoin to fall, that is when we buy, we buy into the dip. Don’t give in to market pressure, keep hodling and wish you all the best on your crypto journey.

Some more news- Amazon getting into Decentralised Finance (DeFi) [link]. I am going to stop here because I try to keep my posts short. I know there are a lot of things to talk about and I will in the subsequent articles. Take care, keep those diamonds hands, HODL!!

Akansha