Bitcoin’s core value proposition is that it is decentralised. If you stand for freedom and are anti-communist , you will like bitcoin.

Anthony Pompliano

I think we need to really educate ourselves on this beautiful open source technology. There is so much bullshit circulating on the internet claiming China is the reason for the recent bitcoin crash when China has been warning against bitcoin since 2013, they also warned against Ethereum in 2016. Start here , it’s a bitcoin white paper , 9 pages, original vision for this. You have to look at podcasts, YouTube videos.Michael Saylor, CEO of Micro strategy, Nick Carter, cofounder of coin metrics, Robert Breedlove, Meltem Demirrors, Isaiah Jackson, Jason Williams, George, CryptosRUs on Youtube, Craig Percoco to name a few.

It would not be fair to talk about bitcoin without touching on some of the first principles of economics. The ones that make the most sense in the context of bitcoin would be inflation and Greesham’s law.I have referenced quite a few resources to put this article together and I will also add credits to those. This is by no means my own recommendation, I have researched this field and simply collated everything that I found useful. If you wish to seek more details, don’t forget to follow Robert Breedlove, a CFA and BITCOIN enthusiast.A lot of the concepts on hypercoinization and 2031 predictions were adapted from his work.I like to be honest and give credit where its due and I will list all my sources for you to deep dive further into the topic.These are uncharted waters and we all must do our own research prior to investing or even having an opinion about bitcoin. I would strongly urge you to spend time learning about this asset as it is as good as it gets.

What is Bitcoin?

Now let’s talk about money. Bitcoin is a pure digital currency and it’s stored and distributed in a way that information doesn’t get lost.Its open source technology that can absorb new feature sets, resist harmful changes, adapt and be responsive to human action. Bitcoin has a four sided network effect – buyers, sellers, miners and entrepreneurs building on top of BTC. To give an example amazon has two network effect- buyers and sellers. The more network effect you have the less prone to disruption you get.To be able to disrupt bitcoin one would have to convince the entire global network to move on one side. Anything that grows beyond 100 billion is usually dominant. Money has five properties –

- Visibility

- Durability

- Portability

- Scarcity

- Divisibility

Bitcoin has perfected all 5 of these. It’s the hardest form of money , now you may ask what do you mean by hardiness? — A major reason that led to the rise of crypto was corruption and violation of the trust fabric which is money.A lot of groundwork for bitcoin was laid out in the past 4 years and covid was a major accelerant to the adoption of digital tech.Bitcoin is a trillion dollar asset now since its first inception in 2008 during the financial crisis.

Why do we need Bitcoin?

In last 200 years , nation states came with their own national currencies but it was difficult to transact the currencies beyond national boundaries. Then rulers decided to print paper currency which was nothing but a written promise to deliver gold , silver as and when person asked for that and government would maintain gold reserves equivalent to value of promissory notes printed .This promissory notes concept became a big tool in the hands of government to create money as and when it required by printing the currency notes without having necessary gold reserves and artificially create demand or meet the expenses of war or other calamity.Since more money got printed without additional good or services creation or having gold reserves , that led to a phenomenon called INFLATION or dearness because more currency for same good and services diluted the value of existing currency and the prices increased accordingly .

To monitor all this printing , government requirements of social welfare , defense expenses and so on , each government established a central reserve bank . This body called as Central Bank , Reserve Bank , Federal or State Bank is a dubious body . This poses as autonomous body but still follows government diktats . Sometimes , it acts as private bank , running banking operations of lending and borrowing , trading in foreign currency while still remaining like an arm of government .

These government run Federal Banks have now lost their credibility . They have no control over currency printing and just act as a shield for politician run government’s financial policies with no long term vision . These are always taking firefighting actions for the government which keeps on borrowing printed money from these central banks . Result is devaluation of currency , increased national debt and now it has taken the ugly form of currency war among countries as they try to devalue own currency to push more export to other country in current WTO led global trade policies .

With increased use of internet technology in financial matters like net banking . money transfer within the country and at global level , some technology geeks tried to bring that gold kind of rarity into digital money. So that government or anybody would not be able to create unlimited money as is happening in currency printing worldwide. It is estimated that there would be 20% more currency printed by big governments to meet the shortfall of tax realisation due to corona epidemic , thereby increasing inflation in coming months.

How is a Bitcoin created?

Bitcoins are generated and distributed as a result of the mining process, it’s the ONLY method through which a bitcoin can be created.

The technology behind Bitcoin is called blockchain. In practice, it is a distributed ledger where all transactions of the network are stored. Blockchain is a chain of blocks, and you can think one block as a text file, which has a long list of transactions.New blocks are added to the blockchain every 10 minutes. There are thousands and thousands of miners competing for the right to add the block 24/7. This competition is done by solving a very complicated mathematical task. The miner who finds the answer first wins “the lottery” and gets to add the next block.This is where Bitcoin is created. There is a certain amount of Bitcoins rewarded for the miner, who creates a new block. This is the incentive for miners to run their machines and compete for block creation.When Bitcoin blockchain was launched in 2009, the block reward was 50 Bitcoins. In other words, there were 50 Bitcoins added to the circulating supply every 10 minutes.As you probably know, Bitcoin’s total supply is limited to 21 million coins. It means that the block reward must go down over time and eventually go to zero. This process is called halving.

What is Bitcoin Mining?

Bitcoin mining is the process of adding records of a new transaction to the Blockchain. New transactions are added in batches called “blocks” roughly every 10 minutes. Bitcoin uses a cryptographic hash function SHA-256 for encryption. This turns your data into a string of a specific, predefined size. The resulting string is called a “hash,” and the process of applying the hash function to random inputs is called “hashing.”

Each time a miner successfully solves Bitcoin’s algorithm (proof of work). When bitcoin miners add a new block of transactions to the blockchain, part of their job is to make sure that those transactions are accurate to avoid duplicity. Then the miner is rewarded with block reward which is a set amount of bitcoins agreed upon by the network. In this way, bitcoins are created.

What are the challenges with Bitcoin ?

Cryptocurrency isn’t made for free. The computer-based miners who create bitcoins use vast amounts of electrical power in the process. To calculate the cost of how much power it would take you to create a bitcoin, you need to know a few things first. First, what is the cost of electricity where you live? Second, how much power would you consume? More efficient computer equipment uses less power, which means lower power bills. The lower the price of electricity, the less cost there is to miners. This increases the value of the bitcoin to miners where the costs are lower to produce.Bitcoin’s exchange rate has moved wildly up and down during its history. If the price stays above the cost to produce a coin, doing the work in an area where energy costs are very low is important to make the practice worthwhile. [thebalance.com]

The energy-heavy process leads some experts to suggest that bitcoin harms the environment.Transaction costs associated with trading are also quite high, to this date we don’t have a good crypto wallet solution that doesn’t have some or the other challenges.

Where is Bitcoin headed?

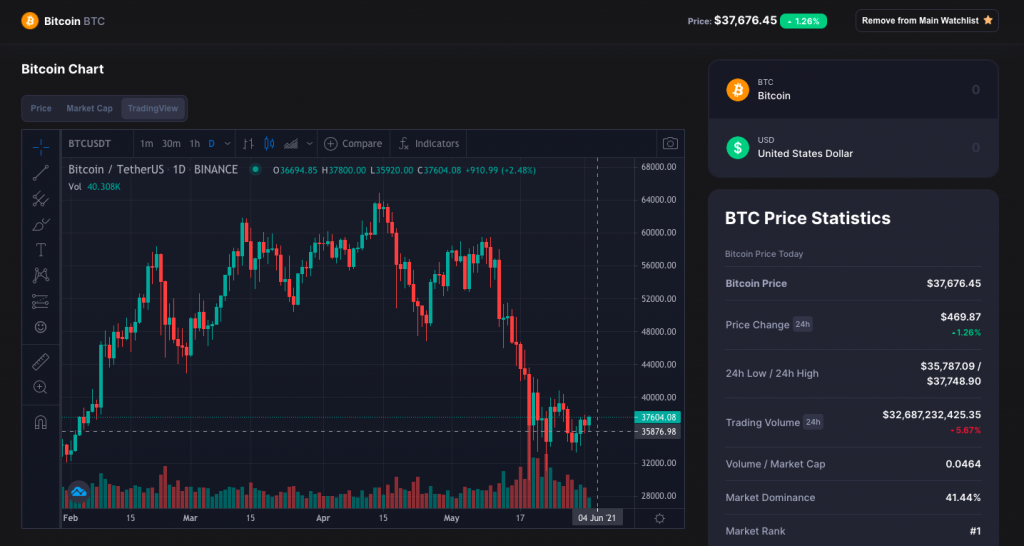

A common question in the cryptocurrency market is – ” Are we going to see a lower low ? and if so where are we going to see all the major pairs start to bottom out?” To answer this you would have to look at price levels, on-chain analytics, and how human psychology ties into market correction.We want to be able to conceptualise these major market pull backs to be able to capitalise.You would have to look at the overall sentiment of the market , going through the UPs and DOWN’s will really help you make rational decisions in times like these. If you compare from 2017 to 2021. In Dec of 2017 bitcoin lost 70-80% of its entire value down to $20k and anyone who continued to hold regardless absolutely crushed it 4 years later.If you bought bitcoin during the 2008 financial crisis , even at the top of 2008, 14 years later you are up a 175%.Long term investing is key here and you have to lower your cost average. That is the mindset.Experts discourage people from panic selling during major market pullbacks and then buying back in FOMO when prices start to rise. If you are still thinking that bitcoin is just a fluke I would like to show you its value 6 years ago vs now. I have an illustration below so please glance over it.

| Timeline | BTC Value |

| 6 years ago | $230 |

| 5 years ago | $529 |

| 4 years ago | $2200 |

| 3 years ago | $7100 |

| 2 years ago | $8700 |

| 1 year ago | $9700 |

Now let’s look at some of the lies that have been circulating while bitcoin is just going through a regular correction cycle.China has always banned bitcoin, on three separate occasions. It’s fairly obvious that they are doing this deliberately to try to shake out a lot of over leveraged traders to be able to cause major pullbacks in the market to then capitalise on it.Don’t put too much purity faith in a lot of people and governments that can influence these markets. Bitcoin is the long term focus, you would not want to compare the stock market to the cryptocurrency market except the cumulative action amongst people and their psychology.

Here is the verdict: Invest in BITCOIN if you are up for the long term game. The second big low will be around the $27000 mark and that is when you should buy into bitcoin if you can. Experts predict that bitcoin in 2031 will be north of $12.5 million per bitcoin at present dollar value. However, adjusting for inflation it would only feel like north of $1 million per bitcoin as dollar would have lost so much of its value.Bitcoin will be 20% of the global purchasing power by 2031 and dollar is not expected to survive beyond 2035. Around 2035 bitcoin would have entered hyperbitcoinization and would have absorbed all of the global monetary premium.Post hyperbitcoinization there would be a time that it would be irrelevant to mention the dollar value of bitcoin and talk in SATS. (More stats under Inflation)

Your move in the crypto market shouldn’t be based on bogus luck or gambling. Neither it should be a mystery.There are some common trading concepts that people use to generate profits from short term cryptocurrency investments.One of those concepts is the Elliot Wave Theory.The Elliot Wave Theory is based on studying wave counts and mass human psychology to predict corrective wave trends.Now before I deep dive into Elliot Wave Theory and give you the real deal I would like to touch on inflation and how currencies have destroyed civilisation. I will do a separate post on the history of money and also how history is tracking itself. Since this post is mainly for bitcoin I am only going to state the lessons learnt and get to the why and how later.

Inflation

If you consider economics from the first principles you’ll come to see inflation as a coercive feeding and a moral force. Inflation is stealing wealth from those who cannot print money by those who can print money. Inflation is the surest way to fertilise the rich man’s field with the sweat of the poor man’s brow.Here is when greesham’s law plays, when bad money enters, good money goes into hiding.In 1971 president Nixon took the dollar off the gold standard and that is when all paper money became debt.Bitcoin is un-inflatable money in a world where wealth is continuously stolen via inflation. Hitler came to power because of Greesham’s law. Inflation progresses according to the law of accelerating issue and depreciation. Supply of money can never be enough to satisfy the debt it creates.The more money the government prints the poorer its people become.Fiat currency was always used to steal from everyone in the society till nothing was left. Its proven time and again that when a currency collapses so does civilisation.Inflation creates shortages in the socio economic sphere leaving the government with nothing but a game of whack-a-mole.When Hyper inflation gets worse we have a revolution.

Compare the downfall of France in between 1791 to 1796 if you need to know how it plays out, they expanded 100x and fully depreciated their currency. In WWI they messed with Reichsmark the german currency at the time.Tying that to present day US, Money supply went up 250% from 2001-2020.From 18% per year they will be forced to 2x the issuance rate to 35%. By 2030 4x that rate, 145% annually.If those rates hold, 35% in 2024 and 145% in 2030, total US M2 money supply would have expanded to $20 trillion 25x to $500 trillion.In the world there would be a wave of smaller currency collapses.Smaller sovereigns with weaker currencies might be collapsing into the dollar. By end of this decade global M2 would be approximately $100 trillion ( $20 trillion in future dollar value). US dollar would have 40% global purchasing power , $500 trillion market cap , taking global M2 to 12x.The whole system has been built on lies, we see in the news people claiming there being no causation between monetary policy and wealth disparity, nothing but a testament to a time we live in.

Elliot Wave Theory for Trading

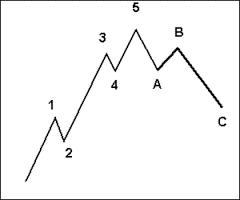

Elliot wave theory analysis studies wave counts and mass human psychology to predict corrective waves in trends.

[Investopedia]

Elliott made detailed stock market predictions based on reliable characteristics he discovered in the wave patterns. An impulse wave, which net travels in the same direction as the larger trend, always shows five waves in its pattern. A corrective wave, on the other hand, net travels in the opposite direction of the main trend. On a smaller scale, within each of the impulsive waves, five waves can again be found.

This next pattern repeats itself ad infinitum at ever-smaller scales. Elliott uncovered this fractal structure in financial markets in the 1930s, but only decades later would scientists recognize fractals and demonstrate them mathematically.

In the financial markets, we know that “what goes up, must come down,” as a price movement up or down is always followed by a contrary movement. Price action is divided into trends and corrections. Trends show the main direction of prices, while corrections move against the trend.

- Five waves move in the direction of the main trend, followed by three waves in a correction (totaling a 5-3 move). This 5-3 move then becomes two subdivisions of the next higher wave move.

- The underlying 5-3 pattern remains constant, though the time span of each wave may vary.

Let’s have a look at the following chart made up of eight waves (five net up and three net down) labeled 1, 2, 3, 4, 5, A, B, and C.

The Most Important Elliott Wave Rules

Now that you have understood what Elliott wave theory is, you need to understand how to apply this into trading. For this, you need to understand some simple rules of the wave patterns:

- Wave 2 cannot retrace the entire wave 1. If it does, then that count is invalidated.

- Wave 3 must be the biggest of the 3 waves formed till that point.

- Wave 4 must not overlap wave 1. If it does, then that count is incorrect. You are looking at the wrong wave structure and it is important that you go back to the beginning again and start counting from a different starting point.

The less predictable outcome is usually the one that happens.A difference between the crypto market and the stock market is that there are no circuit breakers, no hours of operation-its open 24/7, 365 days, there is no plunge protection team that is going to step in and buy and that leads you into high volatility. Now here is what people miss out , volatility works both ways ,works on the way up and works on the way down. Volatility is only bad when it works against you.So if you are short and the price goes up its bad news but if you are long but the price goes down thats bad news.

We are living in the most transformative decade in world monetary history.Bitcoin has made a major impact in the world in its 10 years of existence, and it still holds a great deal of promise for the future.All time beyond the present is unknown and a mystery. All predictions should always be taken with a grain of salt, yes nothing in life is fool-proof. Anyone who claims they can tell you what is going to happen in the future is wrong. All we can do is study the patterns of the past and use them as our map to navigate the ever-advancing territory of the future.

That’s all folks. I’ll see you in the next one.

Akansha